-78c0e.png)

Due to Covid-19, governments around the world, including Indonesia, have instructed social distancing and closing non-essential services to to suppress the spread of the virus and optimize the operation of hospitals with high patient capacity. Given the high rate of disease transmission, especially within hospitals, telehealth technology can be an effective and efficient way to properly contain the spread of the virus and reduce pressure on hospital capacity. Telehealth technology can operate as a filter capable of protecting people who are experiencing symptoms of the virus to stay at home while directing more severe cases to hospitals.

Continue Reading

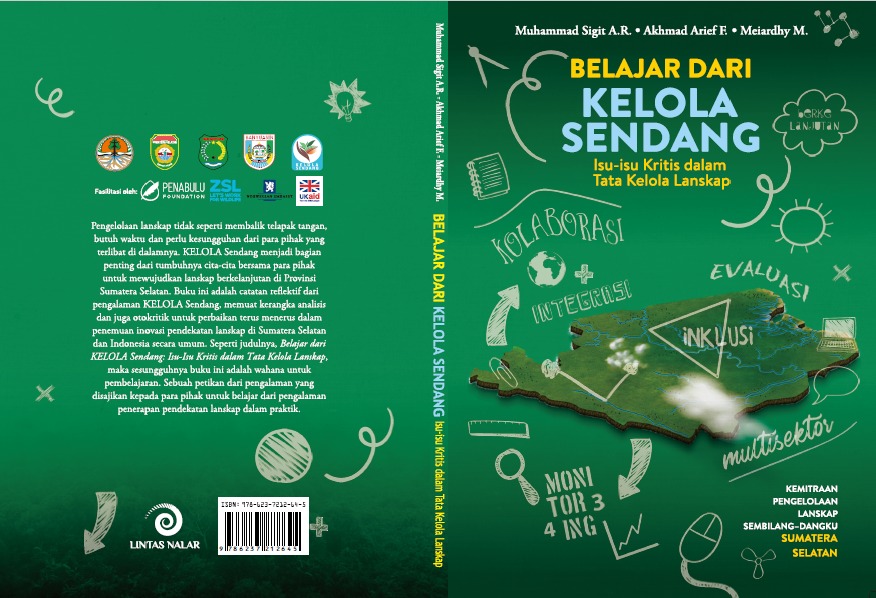

The process of implementing green growth and sustainable landscape management is supported by nine new policies that consistent and support the KELOLA Sendang program. The policy involves government intervention, starting from the South Sumatra Provincial Government, stakeholders, until DPR. Thus, it is hoped that the long-term sustainable landscape management projects can be realized.

Continue Reading

The Financial Services Authority noted that the distribution of micro, small and medium enterprises (MSME) loans continued to grow towards the end of 2020. This condition is expected to continue in line with the high demand for new capital in 2021. Currently there are more than 65 million MSMEs spread throughout Indonesia. It is predicted that the number will continue to increase. (data.tempo.co).

Continue Reading

After explaining the GLA assessment method to measure the success of the KELOLA Sendang program, Sigit and colleague began to describe the KELOLA Sendang program in detail. There are four sub-chapters that discuss this issue.

Continue Reading

In 2017, experts also considered that South Sumatra was the right province to be used as a model for implementing landscape governance. This model will be implemented in all provinces in Indonesia later on. From the aspirations of these experts, Sembilang-Dangku Landscape Management Partnership program (KELOLA Sendang) was born.

Continue Reading

Environment issues have exists since decades. These issues have also becoming the focus of improvement for some big country in the world. It is reflected from the Millennium Development Goals (MDGs) program in the seventh point, which is “Ensure Environmental Sustainability”. However, even after the MDGs program ended in 2015, this environmental sector has not shown any significant improvement.

Continue Reading

BTS Meal is a food package in the form of chicken nuggets, South Korean style McD sauce, french fries, and drinks, which was first available in Indonesia. This food package has been sold in dozens of countries since May 2020. The BTS Meal promo at McD gets a thumbs up in the midst of difficult restaurant sales during the Covid-19 pandemic. According to the Indonesian Hotel and Restaurant Association (PHRI), because of pandemic, thousands of restaurant outlets were closed due to lack of visitors. However, the high interest in buying BTS Meal McD is proof of a successful sales trick by the restaurant.

Continue Reading-f9f9d.png)

Bank Indonesia (BI) has launched the National Non-Cash Movement on August 14, 2014. This movement aims to create a safe, efficient and smooth payment system, which in turn will be able to encourage the national financial system to work effectively and efficiently (bi.go.id). Even so in fact there are still many people who choose cash payments as their payment method, including transactions on e-commerce. In December 2020, Central Statistics Agency released a report stating that the cash on-site payment method or known as cash on delivery (COD) was chosen by 73,04% of online shoppers in Indonesia (bps.go.id).

Continue Reading